July 2025

Designing an EU ETS post-2030 framework is urgent to restore a business case for sustainable flat glass manufacturing in Europe

The European flat glass sector is key to achieving the EU’s decarbonisation goals and the recently proposed target of a 90% reduction in GHG by 2040[1].

Flat glass products help to improve the energy efficiency of buildings, support the transition to clean mobility, and contribute to efficient renewable solar energy generation. In all its applications, flat glass is an irreplaceable material whose technological advances, availability and affordability are critical to many of Europe’s flagship industries, its economic security and low-carbon future[2].

While already producing net carbon-avoidance products throughout their life cycles[3], the flat glass sector has worked tirelessly at reducing CO2 emissions from its manufacturing processes and continues to do so despite greater economic, international competition and technological constraints.

With increased objectives in terms of CO2 emission reduction entailing a reduced CO2 emission cap for EU ETS sectors, designing a new EU ETS framework post 2030 is necessary to restore a business case for sustainable flat glass manufacturing in Europe.

Key considerations

- It is of utmost urgency to design a new EU ETS framework post-2030. The existing phase IV of the EU ETS is not fit for 2030 and beyond due to the new 2040 climate target. ETS Phase IV mechanisms imply the end of free allocation and the rapid depletion of the carbon market, which is a clear deterrent to any investment decision. For flat glass manufacturers having to make investment decisions into new furnaces that will run for 16 to 20 years, clear rules post-2030 are urgently needed to make a viable business case for sustainable production.

- The new EU ETS framework must not penalise industrial investments in the hardest-to-abate sectors where technological solutions to decarbonise are not yet available. While for some sectors, the challenge lays in the deployment of existing decarbonisation solutions, technologies are not available in flat glass manufacturing to reduce CO2 emissions at the level of 76% in 2040 compared to 2030 indicated by the new 2040 target[4], neither in the EU nor beyond. Although the adoption of best available technologies in this sector may not generate as much CO2 emission reduction as defined by the holistic target, it must be supported to curb CO2 emission as much as possible and to ensure the industry can continue to research, test and ultimately deploy novel manufacturing technologies as soon as they become available and economically viable.

- Continuous increase in carbon costs for flat glass manufacturing will be counter-productive to the EU decarbonisation, affordable housing and strategic autonomy agendas. While the EU ETS is underpinned by the idea that the internalisation of carbon costs will generate a switch towards materials with lower carbon content, this dynamic is not applicable to flat glass products, which are irreplaceable in most applications. Systems are therefore needed to mitigate the impacts of increased carbon costs in flat glass manufacturing to avoid making flat glass products more costly, which is at odd with Europe’s own decarbonisation target and its affordable housing agenda.

- An adequate level of protection against the risk of carbon leakage must be guaranteed. Under phase IV of the EU ETS, the flat glass sector receives free allocation up the CO2 benchmark level due to its exposure to risks of carbon leakage. With increased imports from third countries and expected higher carbon costs, this risk will continue to exist and likely increase. Considering that the flat glass sector’s introduction into the Carbon Border Adjustment Mechanism (CBAM) is neither envisaged nor desirable in the short term, it is essential that the sector remains protected against the risk of carbon leakage and that protection increases alongside the risk. The level of protection for non-CBAM sectors must remain effective as they do not enjoy the extra layer of protection of CBAM.

- Free allocation should remain the prime source of protection against the risk of carbon leakage and may need to be targeted more strategically. The current system of protection against carbon leakage by way of free allocation is well established and provides protection while rewarding decarbonisation investments. This system should be safeguarded. As fewer allowances will be available post-2030, free allocation may need to be better targeted. The concept of conditioning free allocation to decarbonisation investments on specific sites should be discarded due to risks of administrative complexity, criteria disconnected from the realities of each sector, and distortion of competition within sectors. As an alternative, new sectoral conditions could be investigated on top of the existing criterion on risk of carbon leakage, for example the availability of decarbonisation technologies, the availability of low-carbon feedstock, the strategic contribution of the industry to the EU policy and decarbonisation objectives, etc.

Glass for Europe believes that a reform is imperative to guarantee that a business case for sustainable flat glass manufacturing exists in Europe and to support the industry’s efforts to look for manufacturing decarbonisation breakthrough.

To this end, Glass for Europe formulates the following policy suggestions for the future EU ETS phase.

1. Continued protection against carbon leakage

With the need to continue enabling Research and Innovation, the levels of investments required in the flat glass sector are largely amplified. At the same time, the capacity to make those investments is currently impacted by high production costs in an increasingly competitive and challenging global landscape. Flat glass production is not only capital-intensive; it is also linked to long investment cycles. A flat glass furnace functions in a continuous manner, without any possible interruption, typically for 16-20 years. During this time, only maintenance operations and limited modifications can be implemented.

- The EU flat glass sector needs the continuation of its protection against carbon leakage. The investment needs and the sector’s exposure to international trade are increasing in parallel. Flat glass will not be covered by the CBAM in the short to medium term. Therefore, it is put at a higher risk of carbon leakage and will require continued protection to preserve its contribution to the EU economy and decarbonisation objectives.

- The protection against carbon leakage should be provided through free allocation. The free allocation system is already in place, offers a good return on experience and has a proven track-record of its efficiency. It is rightly based on the exposure to carbon leakage at sectoral level. A sufficient free allocation level should be foreseen, which can be reduced proportionally to the technological and economical capacity of sectors to deploy transformative technologies, but not before such technologies are available at scale.

2. Adequately calibrated conditionality of support

While an increased emissions reduction target will result in a reduced volume of allowances, choices need to be made to ensure a sufficient level of free allocation to sectors which need to continue being protected in the coming years. If this support needs to be more targeted, a reflection and investigation on additional criteria to carbon leakage exposure should be conducted.

- The Market Stability Reserve (MSR) should play an active role in enabling industrial transformation. Cancellation of allowances from the MSR should be discontinued, instead allowing to make use of these allowances to support the heavy investment needs in sector without available technology to significantly reduce their emissions. This could be done in coordination with the future Industrial Decarbonisation Bank. In addition, the MSR intake and release rates should also be reviewed to ensure enough liquidity is maintained in the market.

- Support should be kept at sectoral level. If a sector is exposed to carbon leakage, then protection must also be sectoral. Disaggregating support to focus on individual installations bears risks of administrative complexity, of selecting criteria disconnected from the realities of each sector and of distortion of competition within sectors. Instead, objective criteria need to be selected, covering all installations within a sector.

- Additional criteria on top of the risk of carbon leakage may need to be investigated. These could be the technological capacity to decarbonise, with availability of technologies at a high TRL level (8-9) and of affordable inputs and infrastructure, and the absence of substitutes to the products necessary to the EU’s decarbonisation and strategic autonomy objectives. The availability of technologies allowing sectors to decarbonise is directly correlated to the risk of carbon leakage, as it increases the gap with non-EU countries.

3. Indirect emissions compensation

The upcoming revision of the EU ETS presents the opportunity to harmonise the protection against the risk of carbon leakage and to incentivise electrification while taking into account the high energy-related production costs faced by some EU industrial sectors. The EU flat glass industry is in the last years composing with a share of energy in production costs of approximately 30%. Beyond the purely technological constraints, this reality is hindering the business case for hybrid flat glass furnaces.

- The revised EU ETS should allow compensation of indirect emissions to the flat glass industry. It would thus support electrification as a decarbonisation route.

4. Flexibility in achieving targets

Flat glass manufacturing is associated to both combustion and process emissions, with a ratio of respectively 75-25%[5]. Decarbonisation pathways researched by Glass for Europe’s members address both emission types; however, they are coming with a number of constraints.

- The EU ETS should be made flexible to negative emissions, carbon removals and the use of international credits, in the respect of transparency and accountability standards. These measures should be especially open to sectors which are otherwise limited in the emissions reductions they can achieve with existing technologies.

5. Targeted support to innovation

The success of Research and Innovation programmes championed by the industry will be key for the achievement of the EU climate targets. Adequate support should be made available in priority to sectors which need to bridge the transformation gap but currently lack the technology allowing them to do so.

- The EU climate policy instruments such as the Innovation Fund, the earmarking of auctioning revenues, and the future Decarbonisation Bank should be conceived as complementary to the EU ETS. The access criteria thereto should be adapted to the needs of the sectors subject to the EU ETS. Their impact should be calibrated so as to result in an effective support helping bridge the technological and economical gap within manufacturing sectors which deliver products necessary to the achievement of the EU decarbonisation goals.

ANNEX 1 – CURRENT FLAT GLASS MANUFACTURING PROCESS AND CO2 EMISSION TRACK RECORD

Many efforts have already been implemented in the EU flat glass sector and further projects are underway. The EU industry has implemented numerous innovation trials including worlds firsts, with tests involving hydrogen or biofuels to power the furnaces, a carbon capture trial, an on-going project for a small-scale hybrid furnace, and the introduction of higher levels of recycled glass in the batch to lower the carbon footprint of the products.

Flat glass represents 0,12% of the total CO2 emissions in the EU (2023 figures). The emissions level has been consistently decreasing for the last decades, with the sector reaching the limits of the existing technologies’ potential.

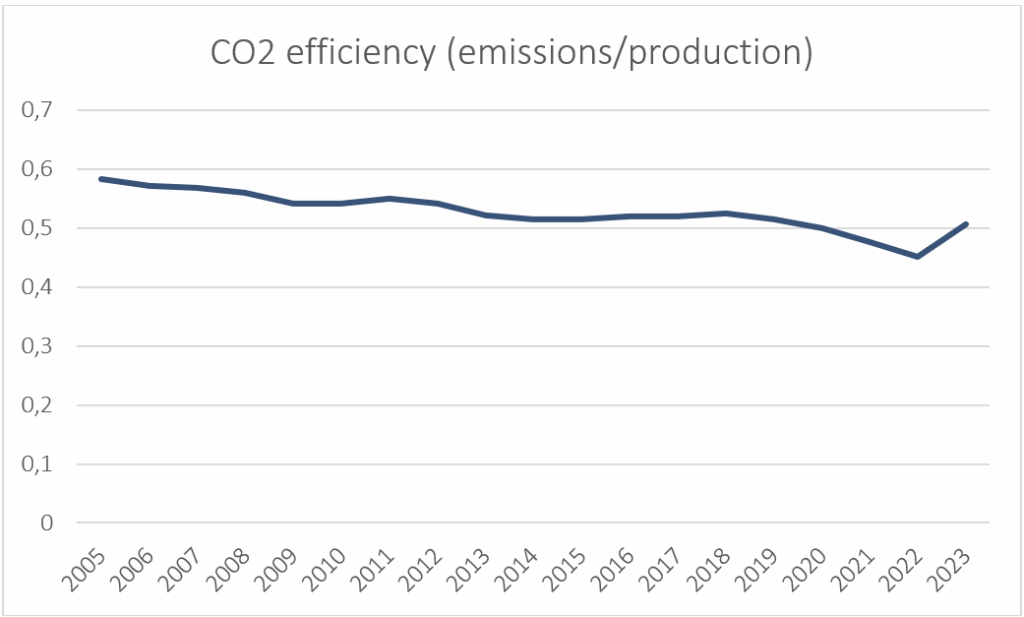

Evolution of average CO2 emissions in the EU flat glass sector

(Glass for Europe’s membership, 2005-2023)

Source: Glass for Europe, based on internal production statistics and EUTL data for GHG emissions

Flat glass melting takes place in very big furnaces, over 60-meter-long, 25-meter-wide and 12-meter-high. While the typical output is 700 tonnes/day, the furnaces have a capacity of up to 2,000 tonnes.

The melting requires reaching one of the highest industrial temperatures, above 1,600°C. It is estimated that the flat glass manufacturing industry uses yearly 61.000 TJ of natural gas in its European installations, which corresponds to approximately 0.4% of the EU’s gross inland consumption (source: Glass for Europe’s estimates, Eurostat).

Flat glass furnaces use natural gas to achieve the necessary heat needed to refine raw materials. A fully electrified furnace would require considerable amounts of electricity and, at present, would not deliver the necessary glass quality level. To elaborate in simple terms: a flame is needed to ‘polish’ the glass surface.

Process emissions represent around 25% of the total emissions from flat glass making. They are linked to the carbon content of raw materials and are typically irreducible. The only way to achieve a notable decline in this share of CO2 emissions is to introduce a higher level of glass cullet (recycled glass) in the furnace.

Flat glass making is a continuous process, functioning 24/7, 365 days per year. An uninterrupted supply of energy is needed to keep the flat glass furnace at the required temperature, for the proper functioning and safety of flat glass manufacturing installations. Changes in temperature generate stress on the refractory bricks, which constitute the shell of the melting furnace, and thus increase risk of industrial hazards.

The flat glass sector is characterised by long investment cycles, with a furnace typically lasting 16-20 years.

Fundamental changes to the furnace, such as the deployment of a new technology, can only be implemented at the end of the lifetime of the furnace, once it has been progressively cooled down to allow its safe dismantling.

ANNEX 2 – LACK OF TECHNOLOGY TO MASSIVELY DECARBONISE FLAT GLASS PRODUCTION

Glass for Europe’s members are committed to continue delivering improvements in the manufacturing process to the utmost of their capabilities. However, the current state of the art technology does not allow to achieve significant reductions of CO2 emissions.

Today, there is no technology available for flat glass manufacturing allowing it to bridge the gap to carbon neutrality by 2050.

A recent Compass Lexecon study[6] for the Enel Foundation recognises that flat glass production is characterised by very high temperatures and process heat requirements. Flat glass making is associated to high technological and economic barriers.

The study finds that only one direct electrification solution could be technically available as a low-carbon technology at scale, only after 2040: resistance heating. As for indirect electrification solutions, hydrogen and biomass are considered, however the flat glass industry, as other sectors, is dependent on their availability and affordability. Hybrid furnaces could also be a possible solution for significant reduction of CO2 emissions. This pathway is actively explored by the EU flat glass sector, with the first testing project ongoing since February 2025[7]. The trials, which are taking place on a small-scale furnace, are expected to last until 2028. If successful, a scaling of this technology to the typical flat glass furnace size would have to be implemented on a selected flat glass site and again tested, before possibly envisaging deployment.

The study also concludes to a substantial cost gap between fossil-based and low-carbon technologies, finding that both CAPEX and OPEX incentives would be needed to tie industrial realities and policy objectives together.

![]()

Another study[8], written by Institut Rousseau and supported by the European Parliament’s Greens Group, has looked into what is needed to put Europe on the path to climate neutrality, while keeping Europe in the global race for competitiveness, in line with the EU’s strategic autonomy agenda. Several industrial sectors are analysed, including glass. The study confirms that the possible decarbonisation pathways for this sector are material efficiency, described as increased use of glass cullet (recycled glass) in the furnace, and energy mix decarbonation, presented as increased biogas/biomass utilisation.

The study finds that the total investment needs for glass sectors in the EU by 2050 are 3.8 billion euros (flat glass represents approximately 35% of all glass sectors in volume).

* * *

[1] European Commission’s proposal on 2040 climate target

[2] Glass for Europe – 2050 I Flat glass in a climate neutral Europe – 2020

[3] Up to 37% of the total energy consumption in the EU building stock can be saved in 2050 thanks to high-performance glazing products – TNO Built Environment and Geosciences, 2019

[4] European Commission’s Impact Assessment on 2040 target, part 3/5, page 68. Such a figure is unattainable with the current most sustainable technologies in the flat glass sector – see Annex I to this paper.

[5] Source: European Commission, 2012, Glass BREF – Description of glass melting technologies, https://op.europa.eu/en/publication-detail/-/publication/ff8a3955-d0d0-46f5-8a15-4b638896cb56

[6] Compass Lexecon study, Reviving Europe’s Industrial Power: How to boost competitiveness through energy, December 2024, https://www.enelfoundation.org/topics/articles/2024/11/potential-and-benefits-direct-indirect-electrification-eu-industry

[7] Volta project, https://www.agc-glass.eu/en/sustainability/hybrid-mid-sized-pilot-furnace-for-flat-glass

[8] Institut Rousseau, Road to Net Zero, January 2024, https://institut-rousseau.fr/road-2-net-zero-en/